₹₹ Union Budget: All that you need to know

A readable summary of every important announcement (for the tech and business sector)

Today is the day when everyone dons the hat of an economist and tells you what’s right or wrong about the budget.

We, instead curate everything for you - saving you time and delivering all the big ideas to you.

Take a cup of coffee (or tea) and enjoy.

Key points

Angel tax abolished

In future, EVs will hopefully get cheaper as mineral import duty waiver has been proposed

If you sell on ecommerce sites, your working capital gets a breather as you will only pay 0.1% TDS

Defense received 12.9% of total Budget of GoI for FY 2024-25!

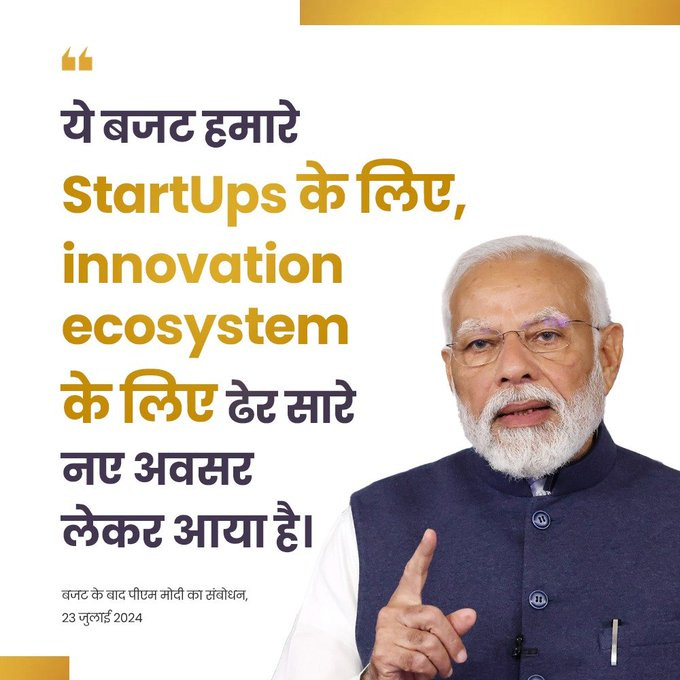

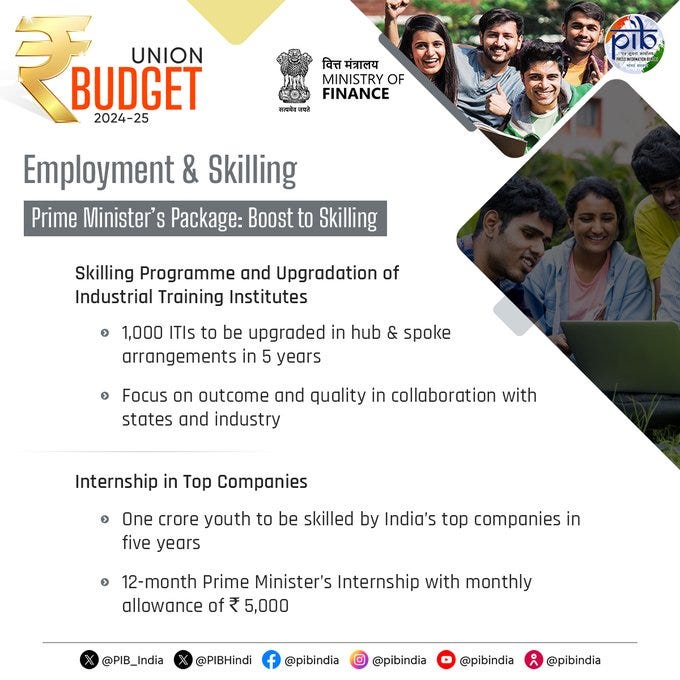

A lot of investment in education/upskilling - we hope this translates to a better skilled workforce a few years from now.

Working women’s hostel and creches to be setup in collab with industry, i.e. special focus on women employment.

Angel Tax abolished.

Really!

FYI: Angel tax was introduced in 2012 to curb money laundering, but finally abolishing angel tax does 10X to the doing business in India ranking, hopefully!

No penalty for non-disclosure of foreign ESOPs, pension assets worth up to Rs 20 lakh: B

“Non-reporting of such small foreign assets has penal consequences under the Black Money Act. Such non-reporting of movable assets up to Rs 20 lakh is proposed to be de-penalised” - FM

1000 Cr VC fund for SpaceTech

The government will set up a Rs 1,000 crore venture capital fund to promote space technology. The size of India’s space economy is around $8 billion now and the government is targeting to take it to $44 billion by 2033.

More DPI Apps

FM has proposed more digital public infrastructure (DPI) in credit, e-commerce, corporate governance as well as in law-and-order sectors.

FM suggested that programmes and applications developed at population scale or for consumer usage to address the delivery of these services to a large segment of the population.

Custom duty waiver on critical minerals like lithium, cobalt for EV battery

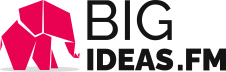

FYI: Minerals such as lithium, copper, cobalt and rare earth elements are critical for sectors like EV, nuclear energy, renewable energy, space, telecommunications etc.

Education sector receives Rs 1.20 lakh crore

Funding for schools has increased by 4.2 percent, from Rs 68,804 crore in 2023-24 to Rs 73,008 crore in 2024-25.

Higher education is allocated Rs 47,619 crore for 2024-25, a 7.68 percent rise from the Rs 44,094 crore in 2023-24.

The TDS rate for e-commerce operators will be reduced to 0.1% (was 1% earlier).

This change is anticipated to assist sellers on platforms like Flipkart, Amazon, Swiggy, and Zomato with their working capital needs.

More

An increased focus on temple tourism

Long term capital gain tax: from 10% to 12.5%

Short term capital gain tax: from 15% to 20%

Govt cuts custom duty; mobile phones, gold & silver jewellery to get cheaper

Defense received 12.9% of total Budget of GoI for FY 2024-25!